Menu

About The Project

In its heyday, the BHP Steelworks facility at Mayfield was rooted in the identity of Newcastle – the Steel City. It played an important role as the city’s biggest employer and as an economic driver sustaining businesses that serviced the industry. Its closure in 1999 shook the region’s economic foundations and the community. The impacts are still felt today.

The BHP site was identified in the 1990s as ideally placed to accommodate a container terminal. Two decades after the Steelworks’ closure, that dream is becoming a reality. The 90 hectares of land will be brought back to life with the construction of the Newcastle Deepwater Container Terminal (NDCT). The NDCT will power the Hunter economy for generations to come and put the site to productive use again. With it, the NDCT will bring $2.5 billion of economic activity to Australia as well as 19,000 direct and indirect jobs.

Large infrastructure projects and their associated benefits can raise relevant questions from the community or from those with a particular interest in the project. We have created a Myths Busted fact sheet in response to some of the common questions.

The Vision

The vision is to construct and operate a world-class, highly-automated container terminal that enables NSW businesses to be more globally competitive by providing more efficient access to international markets. It will have direct ship-to-rail capability, reducing freight time and costs and double-handling of cargo. It will have a throughput capacity of 2 million Twenty-Foot Equivalent Units (standard twenty foot containers or ‘TEUs’) per year, and ensure that Australia is prepared for the future of container shipping and the industry’s transition to the much larger Ultra Large Container Vessels (ULCVs) now operating around the world.

The NDCT will deliver substantial cost savings for NSW exporters and importers. The NDCT represents a once in a generation opportunity for the Hunter region.

View a 3D animation of the NDCT concept design.

Commercial Benefits Of The Container Terminal At Newcastle

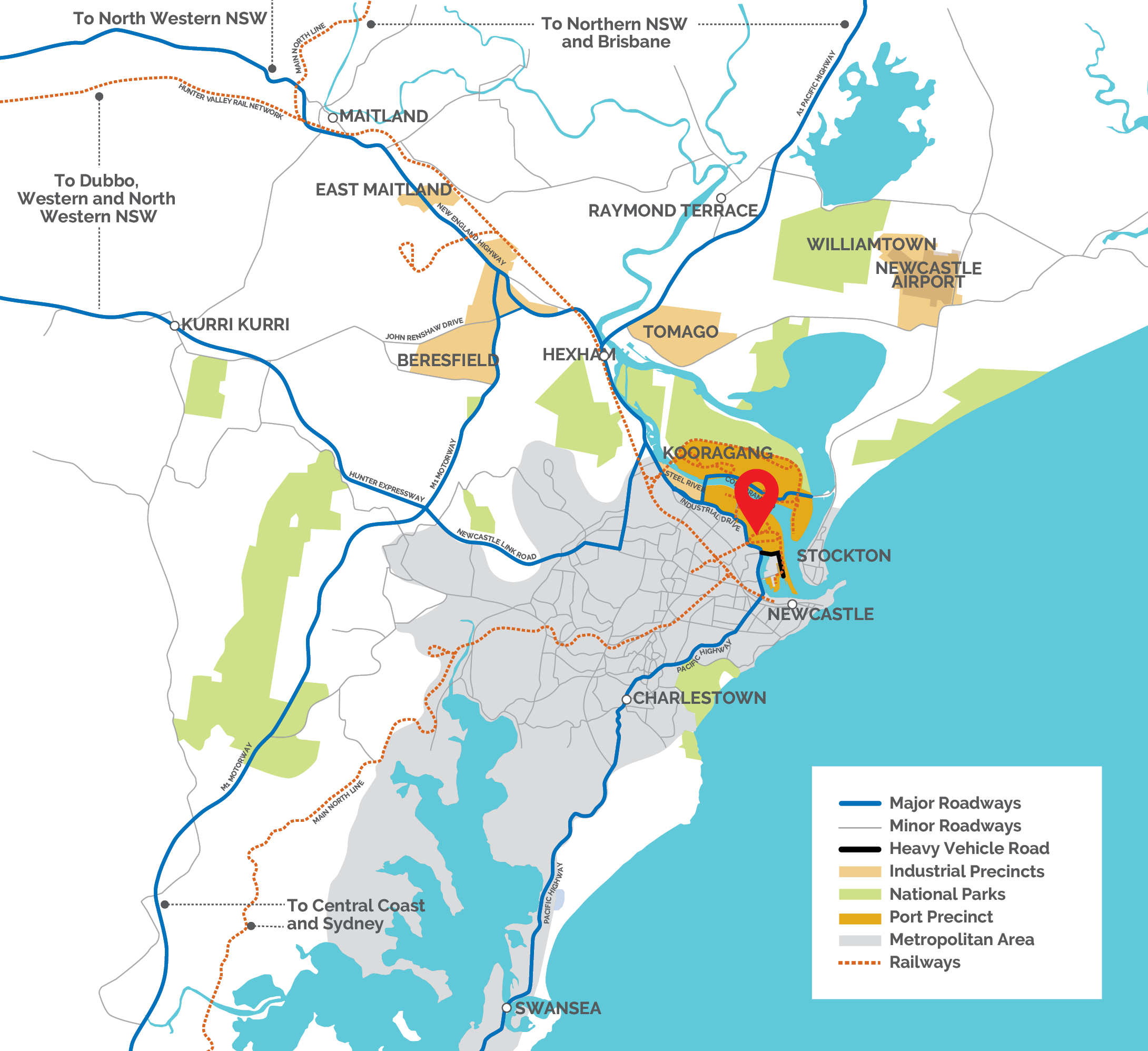

Located midway along Australia’s Eastern Seaboard, with direct connections to national heavy rail and road networks, Newcastle is an efficient option for importers and exporters in northern, western, north western and far western NSW.

Economic analysis by AlphaBeta identified that regional NSW businesses, including those in the Upper Hunter, Narrabri, Tamworth and Port Macquarie would save up to $586 per standard container by shipping through Newcastle compared with Sydney or Brisbane.

The Port of Newcastle Transport Economics Study, prepared by Lycopodium, estimated that the cost of direct transport of containers to Newcastle, servicing the natural freight corridor, is reduced by 30-50%.

Port of Newcastle to provide the backdrop for Australia’s future export opportunity and grow further as a world-leading energy export hub.

Driving Economic Stimulus

& Job Creation

The NDCT project has potential to be a major growth catalyst for the Hunter. It will turbo-charge the diversification of the Hunter economy, ensuring it is resilient and sustainable for

generations to come.

With the removal of contractual restrictions on the development of a container terminal, private investors are prepared to spend the full cost of the $2.4 billion container terminal project.

A study conducted by HoustonKemp , estimated the Newcastle Deepwater Container

Terminal would:

1. Contribute $2.5 billion in economic activity across Australia;

2. Generate over 19,000 direct and indirect jobs across the country;

3. Inject $1.3 billion to the Lower Hunter.

Jobs For Our Community

Generating 12,000 jobs and flow-on benefits worth $1.3 billion to the Lower Hunter, a new container terminal at Newcastle will turbo-charge the economy as it recovers from the effects of COVID-19.

Economic recovery aside, the Newcastle Deepwater Container Terminal (NDCT) will be a major growth and diversification catalyst for the Hunter Region.

A study conducted by HoustonKemp, estimated the Newcastle Deepwater Container Terminal would contribute:

For the foreseeable future, there are no other developments in the Hunter Region

with the same level of scope or potential to generate such significant economic growth.

Port Of Newcastle is already

an economic powerhouse of

the Hunter Region

Port of Newcastle is a major Australian trade gateway handling over 4,600 ship movements and 166 million tonnes of cargo each year.

With its annual trade worth about $37 billion to the national economy, the Port enables businesses across the state to successfully compete in international markets.

With a deepwater shipping channel operating at 50% of its capacity, significant port land available and enviable access to national rail and road infrastructure, Port of Newcastle is positioned to further underpin the prosperity of the Hunter, NSW and Australia.

Future Proofing The Hunter

On a mission to contribute to a more resilient economy for the Hunter Region, Port of Newcastle is pursuing an ambitious diversification strategy that will broaden the mix of cargo it handles and reduce its reliance on any one cargo.

It’s no secret that exporting coal provides significant economic benefits and direct and indirect employment for many people across the Hunter. Global demand for the region’s high-quality thermal coal remains, however there is recognition that this will not continue forever. The Port wants to develop new forms of trade in order to ensure the region’s long-term prosperity.

The task today is to ensure economic continuity. As an engine room of economic activity and employment, Newcastle’s working harbour has a critical role to play in providing accessible, efficient and cost-effective supply chains that underpin local jobs, local businesses and the region’s economic prosperity. Port of Newcastle has an eye on tomorrow, recognising that port projects started today will help underpin economic prosperity for many decades to come.

An uncontained future for the Hunter would see it free from being dependant on a few key commodities and industries. The region would have several significant growth industries that could sustain the economy for the decades ahead. This is Port of Newcastle’s vision and a driving force of its diversification strategy.

The Newcastle Deepwater Container Terminal (NDCT) – Is a key piece of the puzzle.

The NDCT is a $2.4 billion project that will help drive the diversification of the Hunter economy as well as create and sustain jobs for generations to come. The container terminal in Newcastle will contribute $2.5 billion in economic activity across Australia, generate over 19,000 direct and indirect jobs across the country and inject $1.3 billion to the Lower Hunter.

For the foreseeable future, there are no other developments in the Hunter region with the same level of scope or potential to generate such significant economic growth.

Other major initiatives that will underpin

the Port’s diversification strategy include:

- Increasing capacity and efficiency at the Newcastle Bulk Terminal with state-of-the-art infrastructure;

- Continuing to build partnerships with stakeholders to maximise use of the Automotive and Roll-on, Roll-off (ro-ro)hub;

- Partnering with local and international stakeholders to explore opportunities for the Port to leverage the anticipated growing use of hydrogen as an alternative energy source;

- Continued development of commercial partnerships to encourage project cargo, such as wind turbines, to move through Port of Newcastle;

- The continuation and growth of major bulk trades including coal, fertiliser, grain and mineral concentrates.

Australian freight is predicted to double over the next 20 years and beyond.

Port of Newcastle is committed to leveraging this growth for the benefit of the Hunter Region and NSW, now and in the future.

Creating Value For Regional NSW

With A Newcastle Container Terminal

The Port of Newcastle Container Terminal will deliver significant benefits to both farmers and exporters creating an exciting, globally leading supply chain out of the Northern NSW grain belt.

The NDCT will overcome constraints and drive down costs, improve cycle times between farm and port and increase competitiveness in both domestic and international markets.

Australian farmers operate in a global market. Grain sold to Asian markets and beyond are not just competing with other Australian or local product, but producers right around the world including from the Black Sea or Canada.

Each producing region has its own advantages – either low cost labour, highly productive farming practices, proximity to market or world-leading transport models. The end result is that all of these producers are selling to the same global customer, and competition in this globalised marketplace is stronger than ever before.

In Australia, we have some of the best produce and most highly productive farming practices in the world. But as is often the case, given the size of our vast country – the supply chain component of our exporters can be a high cost component. Up to 30 per cent, and in some instances, 40 per cent, of farmers production cost can be wrapped up in transport costs.

| Costs ($/T) | Australia (2013) | Canada (2014) | Australia (2014) | Ukraine (2015-2016) | Russia (2016) | Australia (2016) | Argentina (2017) | Australia (2017) |

|---|---|---|---|---|---|---|---|---|

| Cartage Farm-site | 8.9 (12%) | 10.7 (10%) | 8.9 (11%) | 4.3 (8%) | 3.5 (6%) | 7.8 (9%) | 2.9 (5%) | 7.8 (11%) |

| Upcountry Handling | 11.9 (16%) | 15.2 (14%) 14.4 | 14.4 (17%) | 7.7 (14%) | 9.2 (16%) | 18.4 (22%) | 13.2 (21%) | 10.4 (15%) |

| Storage | 6.8 (9%) | 17.7 (16%) | 8.9 (11%) | 2.9 (5%) | 5.1 (9%) | 9.0 (11%) | 1.4 (2%) | 5.0 (7%) |

| Transport Upcountry to Port | 21.6 (29%) | 46.8 (44%) | 27.8 (33%) | 13.3 (23%) | 15.5 (28%) | 26.7 (32%) | 29.5 (47%) | 23.6 (33%) |

| Port Charges | 21.2 (29%) | 13.9 (13%) | 21 (25%) | 23.8 (42%) | 22.4 (40%) | 19.9 (24%) | 15.5 (25%) | 21.7 (30%) |

| Leavies and Check-offs | 2.9 (4%) | 3.0 (3%) | 2.8 (3%) | 4.9 (9%) | 0.1 (<1%) | 2.8 (3%) | ndb | 2.8 (4%) |

| Total Supply Chain Costs | 73.3 | 107.3 | 83.8 | 56.9 | 55.8 | 84.6 | 62.5 | 71.3 |

| Production Cost | nd | 139.1 | 157.1 | 133.0 | 121.1 | 148.3 | 140.0 | 148.8 |

| Supply Chain Proportion | nd | 0.44 | 0.35 | 0.30 | 0.32 | 0.36 | 0.31 | 0.32 |

Benefits to regional NSW

Port of Newcastle has been focused on delivering a container terminal to improve the agricultural supply chain, particularly in the North West of NSW for a number of reasons.

It is driven by a desire for new growth and revenue of course, but there are a number of additional benefits:

It is driven by a desire for new growth and revenue of course, but there are a number of additional benefits:

MAXIMISING RETURNS FOR FARMERS

BIGGER TRAINS & PAYLOADS

1350m long trains twice the size of the current Botany service.

NETWORK FLEXIBILITY

Dedicated freight network, unlike the Sydney Network.

ENVIRONMENTAL CARE

Rail is a cleaner, greener freight alternative that is three times less carbon intensive and three times more fuel efficient than road.

ROAD SAFETY AND REDUCED FUEL USE

Each of the new large trains is carrying the equivalent of 70 B Doubles of freight. When you consider each day we deliver trains carrying around 23,000 tonnes of freight per hour, that’s the equivalent of a B Triple every ten seconds – without the safety impacts or damage to local roads.

STIMULATE LOCAL ECONOMIES

Every dollar saved by a local farmer, supports jobs and is reinvested into the local community and economy.

OPENING NEW MARKETS

By reducing costs, farmers are more competitive and a more competitive price point brings new markets into play. Leveraging the strong reputation of quality Australian products, it enables growers to operate in new markets.

SUPPLY CHAIN EFFICIENCY

Longer train lengths mean reduced overall train path usage and increased capacity on the rail network. A win for all industries using the network.

| LGA | NEXT CLOSEST PORT TO NEWCASTLE | KM SAVED | KM SAVED (PER CENT) | DOLLARS SAVED PER TEU | DOLLARS SAVED PER TONNE |

|---|---|---|---|---|---|

| Moree Plains | Brisbane | 100 (*) | 20% | $270 | $10.80 |

| Armidale Regional | Brisbane | 150 | 31% | $404 | $16.16 |

| Narrabri | Botany | 191 | 32% | $517 | $20.68 |

| Tamworth Regional | Botany | 191 | 40% | $517 | $20.68 |

| Gunnedah | Botany | 191 | 38% | $517 | $20.68 |

| Liverpool Plains | Botany | 191 | 45% | $517 | $20.68 |

Will save regional NSW billions

The Newcastle Deepwater Container Terminal will deliver substantial cost savings for NSW exporters and importers.

Economic analysis has identified that regional NSW businesses, including those in the Upper Hunter, New England and Northern NSW regions would receive significant savings by shipping through Newcastle compared with Sydney or Brisbane.

If you want to voice your support for the Newcastle Deepwater Container Terminal, please contact your local member and include community@portofnewcastle.com.au in your communications.

| Region | LGA | NEXT CLOSEST PORT TO NEWCASTLE | KM SAVED | KM SAVED (PER CENT) | DOLLARS SAVED PER TEU |

|---|---|---|---|---|---|

| Central West | Dubbo Regional | Botany | 150 | 45% | $445 |

| Far West | Broken Hill Cessnock Lake Macquarie Dungog Muswellbrook Singleton | Botany Botany Botany Botany Botany Botany | 78 175 189 90 191 191 | 6% 78% 90% 70% 60% 71% | $232 $520 $561 $564 $567 $567 |

| Mid-North Coast | Nambucca Port Macquarie-Hastings Kempsey | Brisbane Botany Botany | 142 209 209 | 30% 47% 42% | $422 $621 $621 |

| Northern | Gwydir Inverell Moree Plains Armidale Regional Narrabri Tamworth Regional Gunnedah Liverpool Plains Uralla Walcha | Brisbane Brisbane Brisbane Brisbane Botany Botany Botany Botany Brisbane Botany | 10 15 100 150 191 191 191 191 193 209 | 2% 3% 20% 31% 71% 40% 38% 45% 37% 43% | $30 $45 $297 $445 $567 $567 $567 $567 $573 $621 |

| North-Western | Cobar Bogan Bourke Narromine Western Plains Regional Warren Walgett Brewarrina Gilgandra Coonamble Warrumbungle Shire | Botany Botany Botany Botany Botany Botany Brisbane Brisbane Botany Botany Botany | 78 78 78 78 79 97 117 117 122 122 168 | 10% 12% 9% 15% 17% 17% 16% 14% 24% 20% 34% | $232 $232 $232 $232 $235 $288 $347 $347 $362 $362 $499 |

| Sydney Surrounds | Central Coast | Botany | 72 | 45% | $214 |